Sanara MedTech Inc. Reports First Quarter 2025 Financial Results (Unaudited)

Q1 Net Revenue Increased 26% Year-Over-Year

FORT WORTH, TX, May 14, 2025 (GLOBE NEWSWIRE) – Sanara MedTech Inc. (“Sanara,” the “Company,” “we,” “our” or “us”) (Nasdaq: SMTI), a medical technology company focused on developing and commercializing transformative technologies to improve clinical outcomes and reduce healthcare expenditures in the surgical, chronic wound and skincare markets, today reported its financial results for the first quarter ended March 31, 2025.

First Quarter 2025 Financial Summary

● Net revenue increased 26% to $23.4 million, compared to $18.5 million in the first quarter of 2024.

● Net loss of $3.5 million, compared to a net loss of $1.8 million in the first quarter of 2024.

● Adjusted EBITDA(1) of $0.7 million, compared to $0.3 million in the first quarter of 2024.

(1) Adjusted EBITDA is a non-GAAP financial measure. See the discussion and the reconciliations at the end of this release for additional information.

First Quarter 2025 Operational Announcements

● On January 21, 2025, the Company announced the execution of an exclusive license and distribution agreement with, and minority investment in, Biomimetic Innovations Ltd (“BMI”), a privately-held medical device company headquartered in Shannon, Ireland. Sanara acquired the exclusive U.S. marketing, sales, and distribution rights to BMI’s OsStic® Synthetic Injectable Structural Bio-Adhesive Bone Void Filler, as well as a hardware agnostic adjunctive internal fixation technology (“ARC”).

● On January 21, 2025, the Company announced the expansion of its executive leadership team with new appointments, effective January 15, 2025. Elizabeth Taylor was appointed to the position of Chief Financial Officer, succeeding Michael McNeil, who was appointed to serve as Chief Accounting Officer and Chief Administrative Officer.

● On March 19, 2025, the Company entered into the First Amendment to Term Loan Agreement with CRG Servicing LLC (“CRG”), which amended Sanara’s existing term loan with CRG (as amended, the “CRG Term Loan Agreement”) to provide for up to two additional borrowings under the term loan, and extended the date by which borrowings are permitted to occur to December 31, 2025. The total available borrowing amount under the facility and the related interest rate and fees were not modified. On March 31, 2025, the Company borrowed an additional $12.25 million under the CRG Term Loan Agreement, which may be used for permitted acquisition opportunities and for general working capital and corporate purposes. Pursuant to the terms of the CRG Term Loan Agreement, the Company may make one additional borrowing of up to $12.25 million on or before December 31, 2025.

Management Comments

“The commercial team for our Sanara Surgical segment delivered a strong start to 2025, with net revenue growth in the first quarter of 26% year-over-year, which was consistent with our expectations,” stated Ron Nixon, Sanara’s Executive Chairman and CEO. “Our Sanara Surgical segment revenue performance reflects impressive execution of our commercial strategy, marked by progress in developing our network of distributor partners, adding new healthcare facility customers, and increasing our penetration of existing facility customers. We are pleased to complement our Sanara Surgical segment revenue performance with enhanced gross margins, and while net loss for the Sanara Surgical segment increased $0.2 million on a year-over-year basis, we achieved a $1.5 million improvement in Segment Adjusted EBITDA(1). In tandem, we enhanced our new product pipeline with the execution of an exclusive agreement with BMI, expanded our leadership team with key appointments, and continued to develop our value-based wound care program, Tissue Health Plus.”

Mr. Nixon continued: “Over the balance of 2025, we remain focused on driving revenue growth and improving profitability in our Sanara Surgical segment. In parallel, our Tissue Health Plus team is preparing to launch our first pilot program with a wound care provider group later in the second quarter, while actively pursuing financial partners to invest in the execution of our THP strategy. We look forward to building on our recent progress in 2025, and addressing the large surgical greenfield opportunity that remains ahead of us, for the benefit of all of our stakeholders.”

(1) Segment Adjusted EBITDA is a non-GAAP financial measure. See the discussion and the reconciliations at the end of this release for additional information.

First Quarter 2025 Revenue

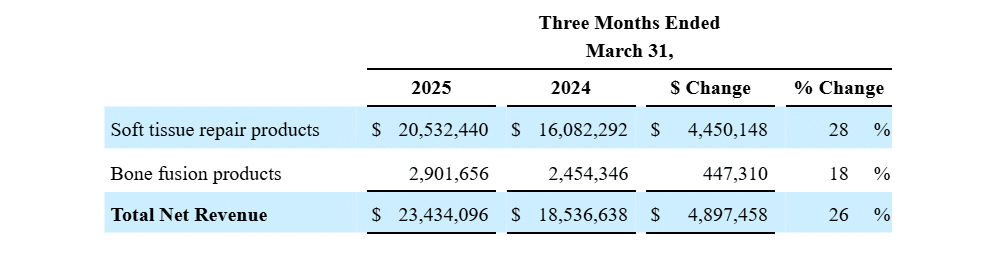

The following table summarizes revenue streams from product sales for the three months ended March 31, 2025 and 2024:

First Quarter 2025 Financial Results

Net revenue for the first quarter of 2025 was $23.4 million, compared to $18.5 million for the first quarter of 2024, an increase of $4.9 million, or 26%, year-over-year. The increase in net revenue was driven by an increase of $4.5 million, or 28%, in sales of soft tissue repair products and an increase of $0.4 million, or 18%, in sales of bone fusion products. The increase in sales of soft tissue repair products was driven primarily by increased demand for CellerateRX® Surgical Activated Collagen® (“CellerateRX Surgical”) and, to a lesser extent, BIASURGE® Advanced Surgical Solution (“BIASURGE”) as a result of the Company’s increased penetration of medical facilities that represent existing accounts, expansion into additional medical facilities, and development of its independent distribution network in both new and existing U.S. markets.

Gross profit for the first quarter of 2025 was $21.6 million, compared to $16.6 million for the first quarter of 2024, an increase of $5.0 million, or 30%, year-over-year. The increase in gross profit was primarily driven by increased sales of soft tissue repair products. Gross margin was 92% of net revenue for the first quarter of 2025, compared to 90% of net revenue for the first quarter of 2024. The higher gross margin realized in the first quarter of 2025 was due to increased sales of soft tissue repair products and lower manufacturing costs related to CellerateRX Surgical.

Operating expenses for the first quarter of 2025 were $23.7 million, compared to $18.2 million for the first quarter of 2024, an increase of $5.5 million, or 30%, year-over-year. The increase in operating expenses was driven primarily by an increase of $5.2 million, or 32%, in selling, general and administrative (“SG&A”) and an increase of $0.2 million, or 18%, in research and development. The increase in SG&A was primarily driven by a $2.4 million increase in direct sales and marketing expenses in the Sanara Surgical segment, $1.7 million of additional SG&A in the Tissue Health Plus segment, and approximately $0.7 million related to the buildout of the Company’s corporate infrastructure.

Operating loss for the first quarter of 2025 was $2.1 million, compared to operating loss of $1.5 million for the first quarter of 2024.

Other expense for the first quarter of 2025 was $1.4 million, compared to $0.3 million for the first quarter of 2024. Other expense for the first quarter of 2025 primarily included higher interest expense and fees related to the CRG Term Loan Agreement.

Net loss for the first quarter of 2025 was $3.5 million compared to a net loss of $1.8 million for the first quarter of 2024. The Company’s Sanara Surgical segment generated a net loss of $0.6 million for the first quarter of 2025, compared to a net loss of $0.4 million for the first quarter of 2024. The Company’s Tissue Health Plus segment generated a net loss of $2.9 million for the first quarter of 2025, compared to a net loss of $1.4 million for the first quarter of 2024.

Adjusted EBITDA(1) for the first quarter of 2025 was $0.7 million, compared to $0.3 million for the first quarter of 2024. The Company’s Sanara Surgical segment generated Segment Adjusted EBITDA(1) of $2.7 million for the first quarter of 2025, compared to $1.2 million for the first quarter of 2024. The Company’s Tissue Health Plus segment generated Segment Adjusted EBITDA(1) of ($2.0) million for the first quarter of 2025, compared to ($0.9) million for the first quarter of 2024.

As of March 31, 2025, Sanara had $20.7 million of cash, $42.8 million of principal debt obligations outstanding, and $12.25 million of available borrowing capacity, compared to $15.9 million, $30.5 million, and $24.5 million, respectively, as of December 31, 2024.

(1) Adjusted EBITDA and Segment Adjusted EBITDA are non-GAAP financial measures. See the discussion and the reconciliations at the end of this release for additional information.

Conference Call

Sanara will host a conference call on Wednesday, May 14, 2025, at 8:00 a.m. Eastern Time to discuss the results for the quarter ended March 31, 2025, and hold a question and answer session at the end of the call. The toll-free number to call for this teleconference is 888-506-0062 (international callers: 973-528-0011) and the access code is 490762. A telephonic replay of the conference call will be available through Wednesday, May 28, 2025, by dialing 877-481-4010 (international callers: 919-882-2331) and entering the replay passcode: 52308.

A live webcast of Sanara’s conference call will be available under the “Events” section of the Company’s Investor Relations website, www.SanaraMedTech.com/investor-relations/. An online replay will be available for approximately one year following the conclusion of the live broadcast.

About Sanara MedTech Inc.

Sanara MedTech Inc. is a medical technology company focused on developing and commercializing transformative technologies to improve clinical outcomes and reduce healthcare expenditures in the surgical, chronic wound and skincare markets. The Company markets, distributes and develops surgical, wound and skincare products for use by physicians and clinicians in hospitals, clinics and all post-acute care. Sanara’s products are primarily sold in the North American advanced wound care and surgical tissue repair markets. Sanara markets and distributes CellerateRX® Surgical Activated Collagen®, FORTIFY TRG® Tissue Repair Graft and FORTIFY FLOWABLE® Extracellular Matrix as well as a portfolio of advanced biologic products focusing on ACTIGEN™ Verified Inductive Bone Matrix, ALLOCYTE® Plus Advanced Viable Bone Matrix, BiFORM® Bioactive Moldable Matrix, TEXAGEN® Amniotic Membrane Allograft, and BIASURGE® Advanced Surgical Solution to the surgical market. In addition, the following products are sold in the wound care market: BIAKŌS® Antimicrobial Skin and Wound Cleanser, BIAKŌS® Antimicrobial Wound Gel, and BIAKŌS® Antimicrobial Skin and Wound Irrigation Solution. Sanara’s pipeline also contains potentially transformative product candidates for mitigation of opportunistic pathogens and biofilm, wound re-epithelialization and closure, necrotic tissue debridement and cell compatible substrates. The Company believes it has the ability to drive its pipeline from concept to preclinical and clinical development while meeting quality and regulatory requirements. Sanara is constantly seeking long-term strategic partnerships with a focus on products that improve outcomes at a lower overall cost. For more information, please visit SanaraMedTech.com.

Information about Forward-Looking Statements

The statements in this press release that do not constitute historical facts are “forward-looking statements,” within the meaning of and subject to the safe harbor created by the Private Securities Litigation Reform Act of 1995. These statements may be identified by terms such as “aims,” “anticipates,” “believes,” contemplates,” “continue,” “could,” “estimates,” “expect,” “forecast,” “guidance,” “intends,” “may,” “plans,” “possible,” “potential,” “predicts,” “preliminary,” “projects,” “seeks,” “should,” “targets,” “will” or “would,” or the negatives of these terms, variations of these terms or other similar expressions. These forward-looking statements include, among others, statements regarding the timing of the Company’s planned commercial launch of its Tissue Health Plus platform, the Company’s business strategy and mission, the development of new products, the timing of commercialization of the Company’s products, the regulatory approval process and expansion of the Company’s business into value-based skincare, wound care and other services. These items involve risks, contingencies and uncertainties such as uncertainties associated with the development and process for obtaining regulatory approval for new products, the Company’s ability to build out its executive team, the Company’s ability to identify and effectively utilize the net proceeds of the CRG Term Loan Agreement to support the Company’s growth initiatives, the extent of product demand, market and customer acceptance, the effect of economic conditions, competition, pricing, uncertainties associated with the development and process for obtaining regulatory approval for new products, the ability to consummate and integrate acquisitions, and other risks, contingencies and uncertainties detailed in the Company’s SEC filings, which could cause the Company’s actual operating results, performance or business plans or prospects to differ materially from those expressed in, or implied by these statements.

All forward-looking statements speak only as of the date on which they are made, and the Company undertakes no obligation to revise any of these statements to reflect future circumstances or the occurrence of unanticipated events, except as required by applicable securities laws.

Investor Relations Contact:

Jack Powell or Mike Piccinino, CFA

ICR Healthcare